2020-11-23 16:34:37

Sustainability to Remain Key for Beauty Industry Players

2020-11-23 16:34:37

Before COVID-19, sustainability in beauty packaging was expected to be the key area of focus and emerging area of innovation. Consumers in developing and emerging markets were pressuring companies to go beyond post-consumer recycled packaging, and utilize renewable raw materials or develop the infrastructure for circular-use packaging.

Sustainability Takes a Temporary Back Seat

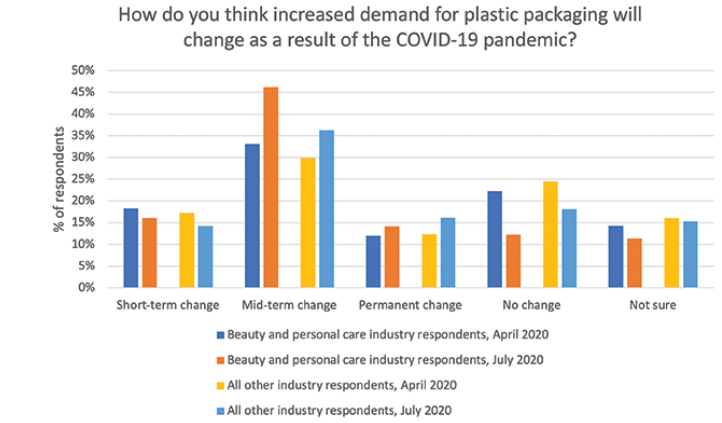

The pandemic, however, has created a short- or mid-term shift in how beauty companies are prioritizing sustainability, focusing instead on hygiene and sanitation. In the immediate outbreak phase, there has been less sensitivity about single-use packaging, additional seals and shrink wraps—as shown by increased plastic packaging demand becoming a mid-term change among beauty and personal care industry respondents in July 2020 than in April 2020. However, sustainable packaging is a long-term trend with staying power in the beauty industry. It is part of a growing movement toward “conscious beauty” in which the environmental impact of a beauty purchase is as important as functionality, price, benefits, and other product-centered features.

The earliest beauty category to embrace this movement toward sustainability was skin care. Other than bath and shower (which Euromonitor tracks as including liquid soap and hand sanitizer), skin care has been the most resilient category in a Covid-19 environment, solidified by the category’s synonymous association with wellness, self-care, and skin health. Based on these drivers, as well as the proliferation of skin care brands ranging from all price points and growth of e-commerce for skin care brands, Euromonitor predicts that skin care will be the most optimistic category globally.

Among Euromonitor’s three adverse Covid-19 economic scenarios, skin care is predicted to grow 3.3% globally from 2019 to 2024 in its least pessimistic scenario, C19 Pessimistic 1. By examining the demographics of skin care users and the attributes of skin care products, beauty stakeholders can be better informed about what sustainable features consumers are looking for in skin care and in which regions, in order to gain a competitive edge in skin care, which has proven to be the most resilient during the pandemic.

Who Most Desires Sustainable Packaging for Skin care?

Among global consumers of skin care seeking out sustainable packaging features, “recyclable packaging” was the most desired sustainable packaging skin care feature, followed by recycled packaging and lastly refillable bottles. This is expected, since the concept of recycling is more familiar and long-established, compared to refillable bottles. Also expected was the fact that younger cohorts, Generation Z and Millennials, place slightly more emphasis on sustainable packaging features than older cohorts, aligning with the narrative that younger consumers are more likely to support brands that align with their personal views. But seeing the degree to which extensive skin care users over-indexed all other segments in desiring sustainable packaging features is an important takeaway, suggesting that skin care companies who cater to extensive skin care users should be incorporating sustainable packaging features in their product offerings.

Sustainable Packaging Claims Dominated by Recycled

Euromonitor International extracted data of stock keeping units (SKUs) from more than 1,500 online retailers to track 150 product claims in 11 industries across 40 countries. The Product Claims and Positioning system can be used to understand trending claims, share of product claims in a given category and brand positioning across dietary, ethical and clean labels.

Recycled, can be recycled, biodegradable packaging, widely recycled, and recycled PET were the top five sustainable packaging claims globally in skin care in 2019. Across these five claims, recycled claims were 8.5 times higher than the second most-used claim, validating Euromonitor International’s survey data that sustainable packaging was most closely associated with recycled features. However, there are some schools of thought suggesting that recycling is not as effective as waste reduction because it still requires resources and costly labor to produce recycled packaging. Still, sustainability is not a zero-sum game, and innovation in any of these claims is a step in the right direction, such as food-based renewable packaging sources and biodegradable packaging.

Regions with the Most Emphasis

Western Europe places the most emphasis on sustainable packaging claims in skin care, but the rise of Asia Pacific is concerning to the sustainability movement in beauty.

Nevertheless, regional focus on recycling is still an important mainstay in the path to sustainability, however, the readiness of each region is quite varied. Western Europe leads with the highest penetration of sustainable packaging claims in beauty and personal care, followed by North America and third, Asia Pacific. While the skin care markets in Western Europe and North America are expected to grow 0.2% and 0.9% CAGR from 2019 to 2024 respectively, in Euromonitor’s C19 Pessimistic 1 scenario, Asia Pacific’s skin care market is projected to grow 5.5% CAGR in the same time period—far outpacing any other region’s skin care growth in size and scale.

While this strong growth will help offset skin care declines in other markets, it may be a warning sign for the sustainable packaging movement, since the penetration of sustainable packaging claims in the APAC region is notably lower than other regions, but also does not encompass widely recycled, recycled PET and Terracycle claims. This dynamic may change in the next three years, since multinational CPGs that set sustainability deadlines are still in the process of converting their operations to be more sustainable, which includes re-work in Asia Pacific. It is also an opportunity to shape the conversation of sustainable packaging in the region, given greater importance of hygiene, cleanliness and purpose brought on by Covid-19. However, companies are not incentivized to incorporate sustainability unless demand is generated from the consumers.

Shifting Consumer Values

In the short-term, beauty companies are expected to display a level of social sustainability amid the outbreak. However, in the long-term, the pandemic has accelerated the corporate shift toward purpose over profit, forcing businesses to move from talk to action, putting social sustainability at the core of their decisions. Even if the adverse effects from the pandemic subside in 2021 or 2022, the beauty industry is left to face another crisis—environmental sustainability.

With consumer values permanently affected from the changes brought on by the pandemic, it could be possible that a wider span of the beauty and personal care industry will rise to the occasion to solve sustainability challenges, underscoring the importance of beauty players that should be preparing for that wave of change now.

LinkedIn